Table of Content

Many wonder if they will be able to keep all of their assets when it comes time to move to a nursing home as all costs rise, and the cost of dementia care even more so. There are some things you need to know about your assets and nursing home care. Medicare Advantage plans don’t usually cover nursing home care that’s considered custodial care. A few exceptions exist, including if a person’s plan has a contract with a specific nursing home or organization that operates nursing homes. The programs cover services like hospital stays and outpatient services and preventive care. Medicare may cover short-term stays in a nursing home when a person needs skilled care.

Medicaid will pay 100% of the cost of nursing home care for its beneficiaries. However, to be eligible for Medicaid nursing home care, the patient must have very limited income and very few financial assets (ballpark limits are assets valued under $2,000 and monthly income under $2,523 in 2022). Assisted living costs have continued to rise as well, though assisted living communities are much more affordable than nursing homes. The median cost of assisted living facilities is $148 per day, which equates to $4,500 per month, or $54,000 per year. While this represents an increase over the past few years, assisted living is far more affordable than semiprivate or private rooms in nursing homes. It's important to note that these figures don't take into account specialized care, such as memory care, or considerations for disabilities.

How does someone qualify for nursing home coverage with Medicare?

Bring some lotion and offer to put some on your spouse’s hands or massage their neck and back. Scheduling visits is a good way to ensure that you don’t let too much time go by. The other advantage of a visit is the opportunity to assess the care your spouse is receiving. During the COVID-19 pandemic, visits to nursing homes were prohibited.

This calculation results in a number of months for which a person making a transfer is ineligible for Medicaid. There is a question on the Medicaid application that reads, “Have you transferred any assets to an individual in the last five years? ” If a transfer has taken place during that period of time, there will be a period of time the Medicaid applicant is not eligible for Medicaid. In answer to the question of how much money can you keep going into a nursing home and still have Medicaid pay for your care, the answer is about $2,000.

Who’s eligible for VA nursing home benefits?

Medicaid can be approved retroactively for up to three months prior to the date of nursing home Medicaid application. In these cases, Medicaid pays the nursing home for the beneficiary’s care and the nursing home refunds to the family what they have spent. The focus of this article is how to get a loved one into a nursing home that accepts Medicaid payments. Since the majority of persons in nursing homes for long term care utilize Medicaid to pay the bill, it is relevant to most families.

The rules are different for a traditional IRA, which involves pre-taxed money. When you withdraw money from such an account, both the investment and any gains are taxed at your current income tax rate. There also is a 10% penalty if you withdraw any money before age 59 ½. However, there are some exceptions to this penalty; and one is unreimbursed medical expenses. Many people grow up with grandparents who lived for years in their homes and, despite various illnesses and conditions, never saw the inside of a nursing home. She has written for senior audiences for about six years and specializes in health, finance, and lifestyle content.

Determine Your Medicaid Eligibility

Physical therapy, exercise assistance and opportunities for social interaction are usually offered to residents as well. This type of insurance policy can help pay for many types of long-term care, including both skilled and non-skilled care. Some policies may cover only nursing home care, while others may include coverage for a range of services, like adult day care, assisted living, medical equipment, and informal home care. This is because Medicare is designed to provide other types of coverage. For example, Medicare provides health insurance for specific kinds of hospital expenses.

Consult with a knowledgeable elder law specialist, who can advise you properly. It’s hard to offer advice without knowing more information about your situation. Medicaid won’t cover rent, of course, but it may cover in-home services.

Paying for nursing home care with private pay options

There are many stories of how hard this was on both the resident and the families. You may be able to keep a portion of your assets when your spouse goes into a nursing home, and your spouse may still qualify for Medicaid. The community spouse may be eligible to keep up to one-half of the couple's total assets up to a maximum of $130,380. When a spouse goes into a nursing home, the experience can be very emotionally and financially disruptive.

In a nutshell, if you move to a nursing home where Medicaid pays for part of your stay, your SSI benefit may be terminated or lowered. On the other hand, if you pay for a private facility, your state may supplement your SSI payment. At any rate, it is important to know what line-item LTSS are covered in assisted living, so you can arrange any additional services that are necessary. For instance, you may need to pay extra for laundry or cleaning services. A Medicaid lawyer can help you navigate the eligibility requirements. One way to find a qualified lawyer is to call your local bar association and find out which attorneys are teaching seminars on Medicaid planning to other attorneys.

In some cases, individuals and families may choose skilled in-home nursing care, which is typically provided by a registered nurse or certified therapist who can administer medication and monitor their vitals regularly. Other states have no income limit but instead require the beneficiary to pay almost all income to the nursing home, with Medicaid paying the balance of the nursing home’s charges. In these states, the Medicaid program allows the resident to keep only a small amount — about $50 to $100 per month — for personal needs. The cost of nursing home care in the U.S is prohibitive for many, and it can vary widely between regions and states, from around $5,000 per month up to a surreal $25,000 per month. How much a nursing home charges depends on its geographic location, staffing levels, the complexity of care offered and the facility’s size and quality.

However, depending on the veteran's household income, there may be copayments required. Retirement income.Retirement income can include social security benefits, benefits from annuities, retirement or profit sharing plans, insurance contracts, or IRAs. Speak with an accountant about potential tax breaks and credits for using retirement income to pay for nursing home care. Resources vary by location, care needs, and financial eligibility. For eligible beneficiaries, Medicaid pays the full cost of room and board in a nursing facility, plus any therapies that are part of the nursing home’s regular resident care.

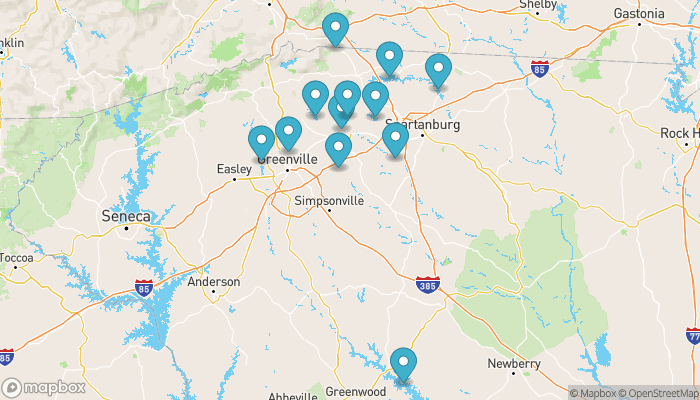

2) Create a list of Medicaid nursing homes in your geographic area. Prior to continuing, the reader should be aware that families are often trying to accomplish two goals at the same time. 1) Getting approved by Medicaid and 2) Getting into a nursing home that accepts Medicaid. Families that want to avoid losing a treasured home, therefore, might choose to forgo Medicaid, especially if the applicant’s life expectancy is short and relatives have the means to pay anticipated costs out of pocket.

Whether your spouse qualifies for Medicaid will depend on where you live, as well as a very complicated asset and income criteria. There are a growing number of options for senior living, and though many seniors would prefer to stay in their own homes, it sometimes becomes necessary to move them somewhere that can offer a better quality of life. Luckily there are options that still allow seniors to remain independent and enjoy the comfort of a home-like setting.